16 Feb 2026

Atomico's annual 'State of European Tech' report for 2023 is out, and it highlights the rapid rise of deep tech in Europe

Pan-European investment firm Atomico has released the ninth edition of its annual 'State of European Tech' report, along with its partners Orrick, HSBC Innovation Banking, Slush and a host of data providers.

The mammoth report, after almost a decade, consistently provides a comprehensive look at the tech industry over in this part of the world.

Let's have a look at some of the main take-aways that we believe are most relevant to EIC Scaling Club members (and fans).

For one, deep tech / deeptech got 24 mentions throughout the report, which is more than, say, fintech (5 mentions), SaaS (2 mentions) and ecommerce (8 mentions).

Bring terms like 'climate tech' and 'AI' into the mix, and you can tell the report is quite heavy on deep tech (which shouldn't be a surprise).

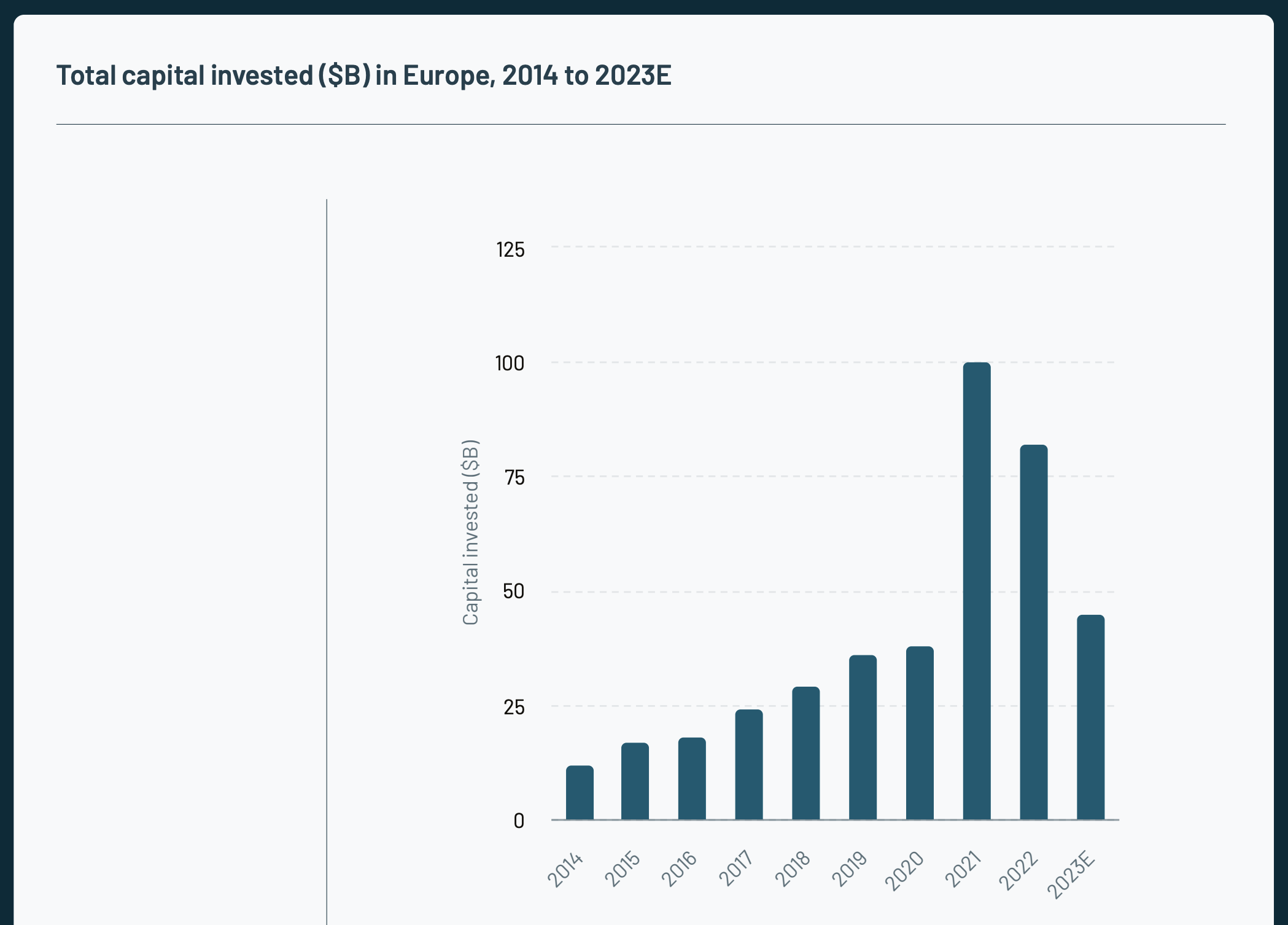

According to the report, European tech startups and scale-ups are on track to raise approximately $45 billion in capital this year.

According to the report, European tech startups and scale-ups are on track to raise approximately $45 billion in capital this year.

While this figure is a notable decrease from 2022’s $82 billion and 2021’s record $100 billion, this year's number is the third-highest figure on the record.

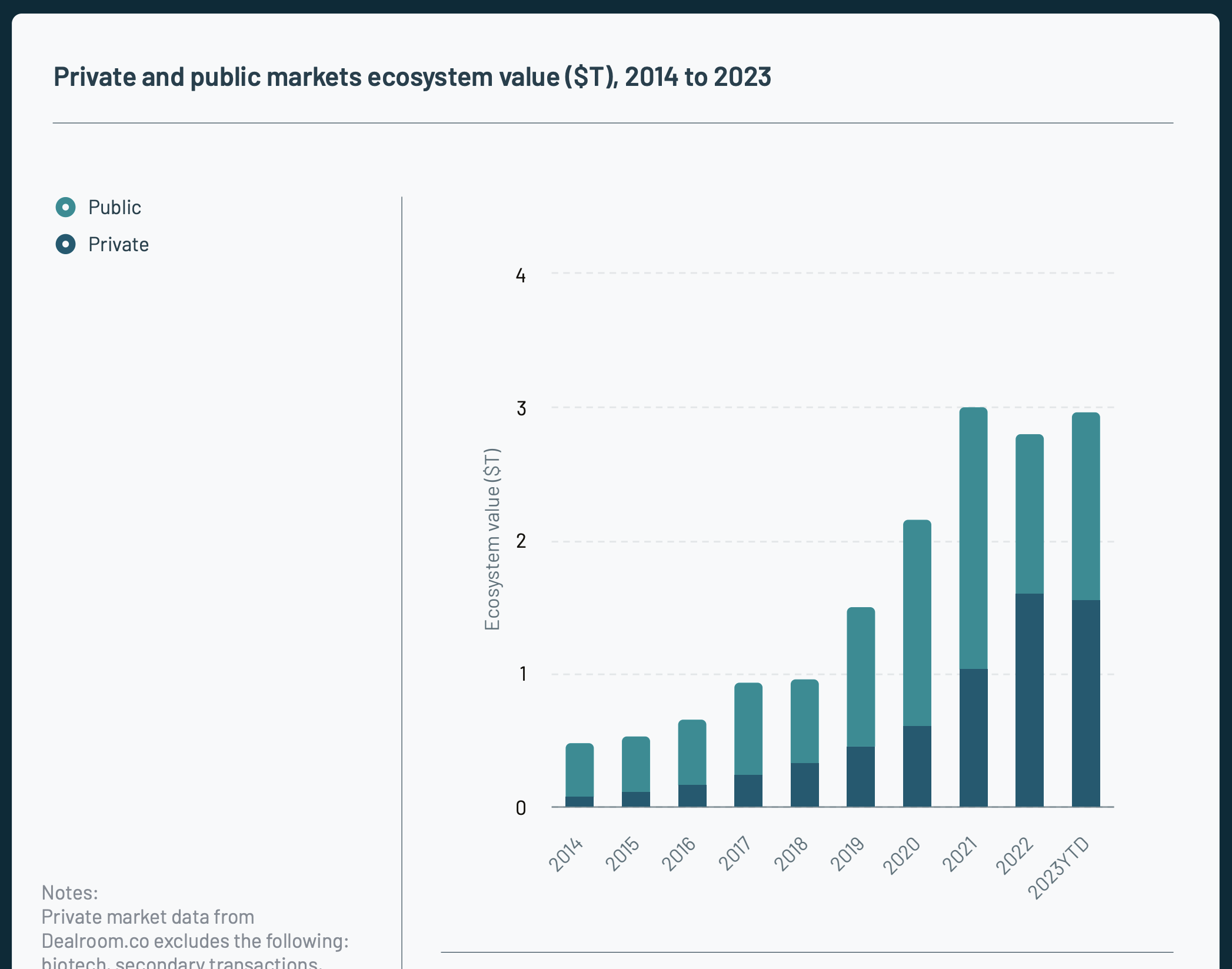

That said, one of the ‘north star’ metrics for the European tech ecosystem, its total value as measured by the combined equity value of all tech companies headquartered in the region across both public and private markets, bounced back to the $3 trillion mark this year.

That said, one of the ‘north star’ metrics for the European tech ecosystem, its total value as measured by the combined equity value of all tech companies headquartered in the region across both public and private markets, bounced back to the $3 trillion mark this year.

According to the report, this rebound in ecosystem value was supported by the continual influx of new companies starting and raising private capital for the first time.

On a related side note: the report highlights that the meteoric rise of tech entrepreneurship in Europe has resulted in the number of new tech startups founded each year in Europe exceeding the US for each of the past five years.

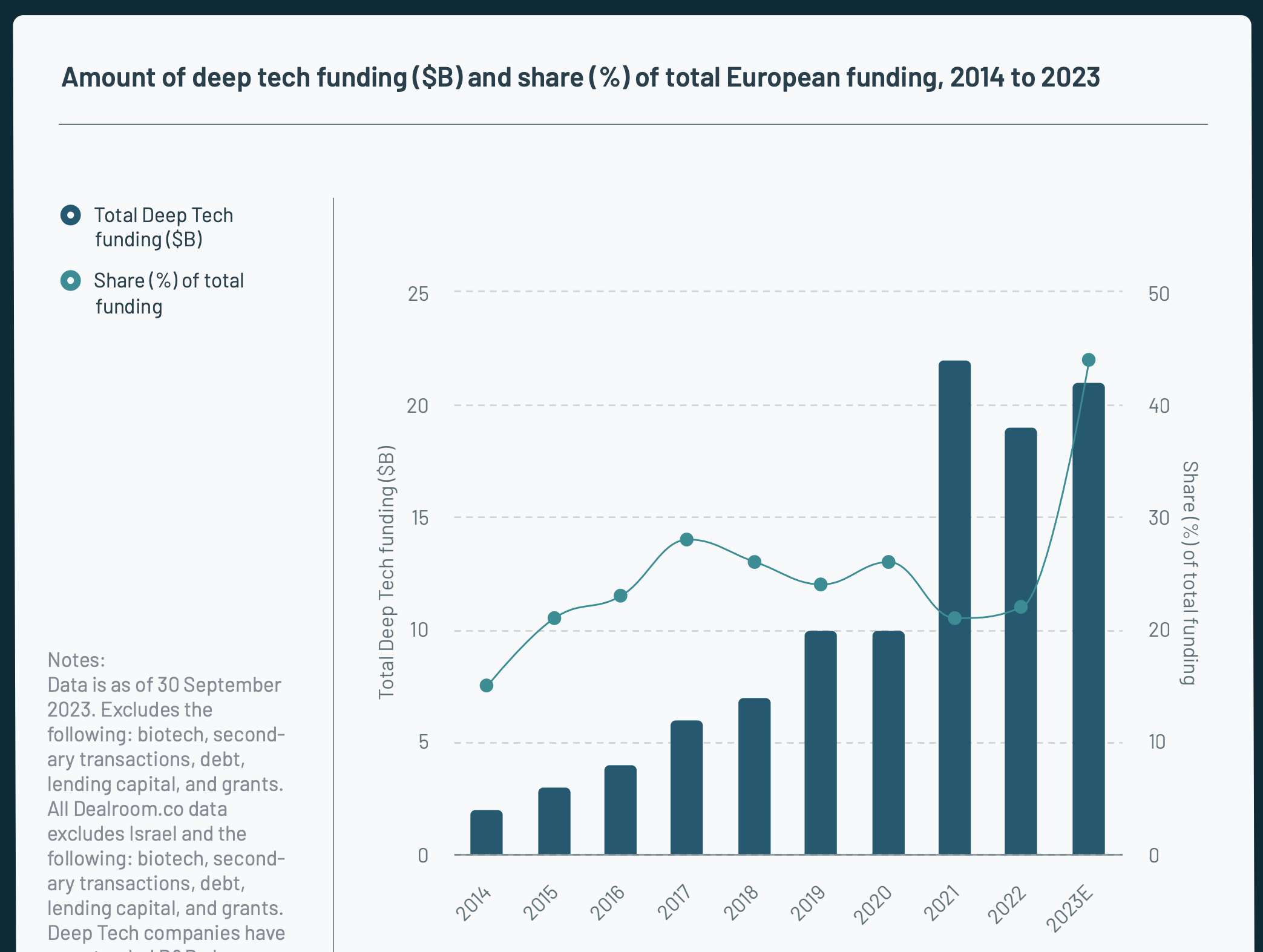

The share of investment allocated to European deep tech companies - which Atomico deems "an umbrella category for companies that apply breakthroughs in science and engineering to come up with novel products and services" reached a record-breaking 44% of total capital invested in 2023, up from just 15% of total investment volume a decade ago.

The share of investment allocated to European deep tech companies - which Atomico deems "an umbrella category for companies that apply breakthroughs in science and engineering to come up with novel products and services" reached a record-breaking 44% of total capital invested in 2023, up from just 15% of total investment volume a decade ago.

The rise of climate tech, in particular, is undeniable.

The rise of climate tech, in particular, is undeniable.

From the report:

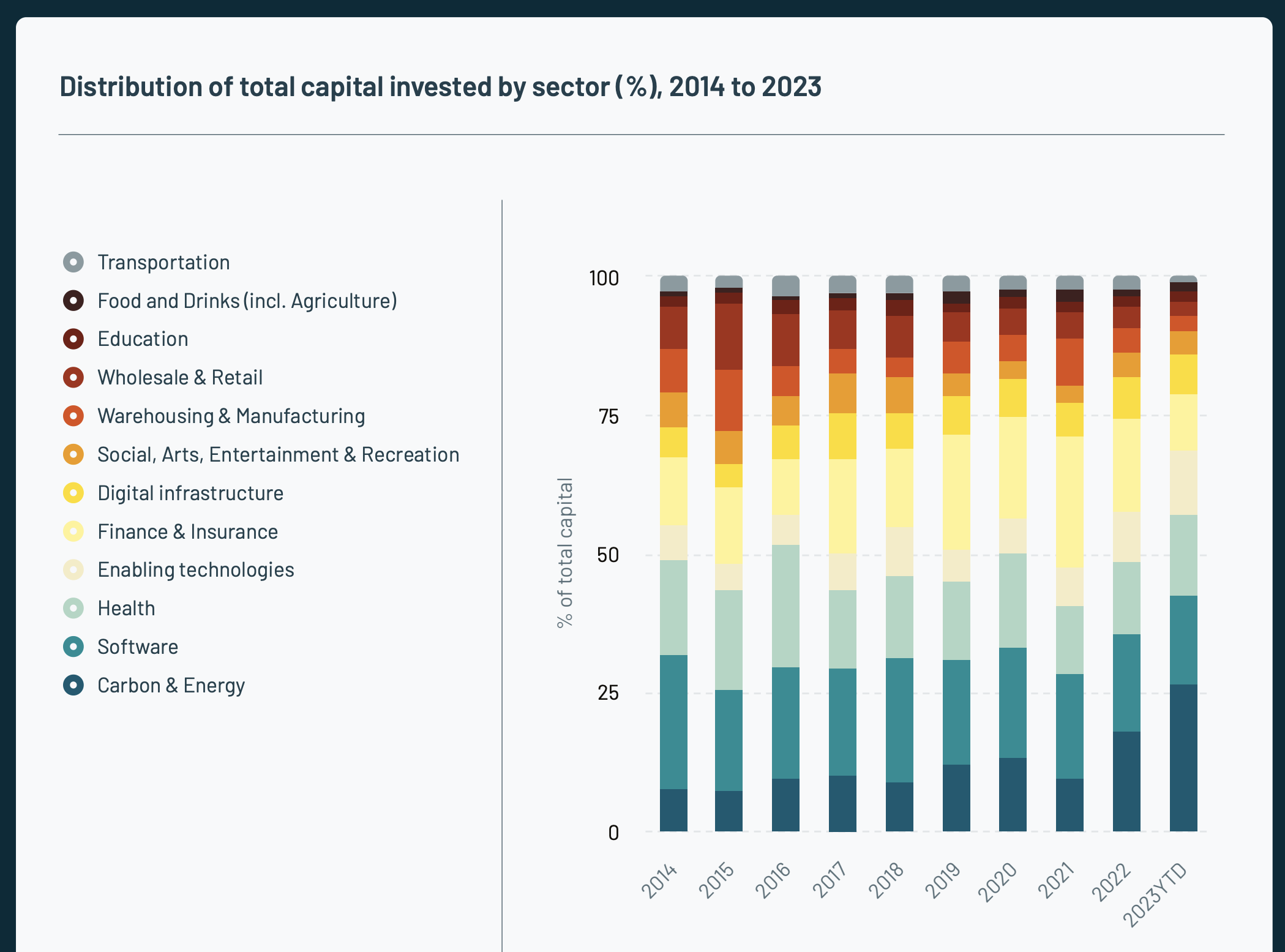

"Remarkably, the Carbon & Energy sector, which encompasses climate tech, accounts for 27% of all capital invested in European tech in 2023, more than doubling its share of investment since 2021. This has seen the sector overtake Finance & Insurance, as well as horizontal Software as the single largest sector by capital raised." Looking at the distribution of capital invested in 2023, the largest flows of capital under the 'Sustainability' theme went to the Transportation, Energy, Manufacturing and Carbon sectors.

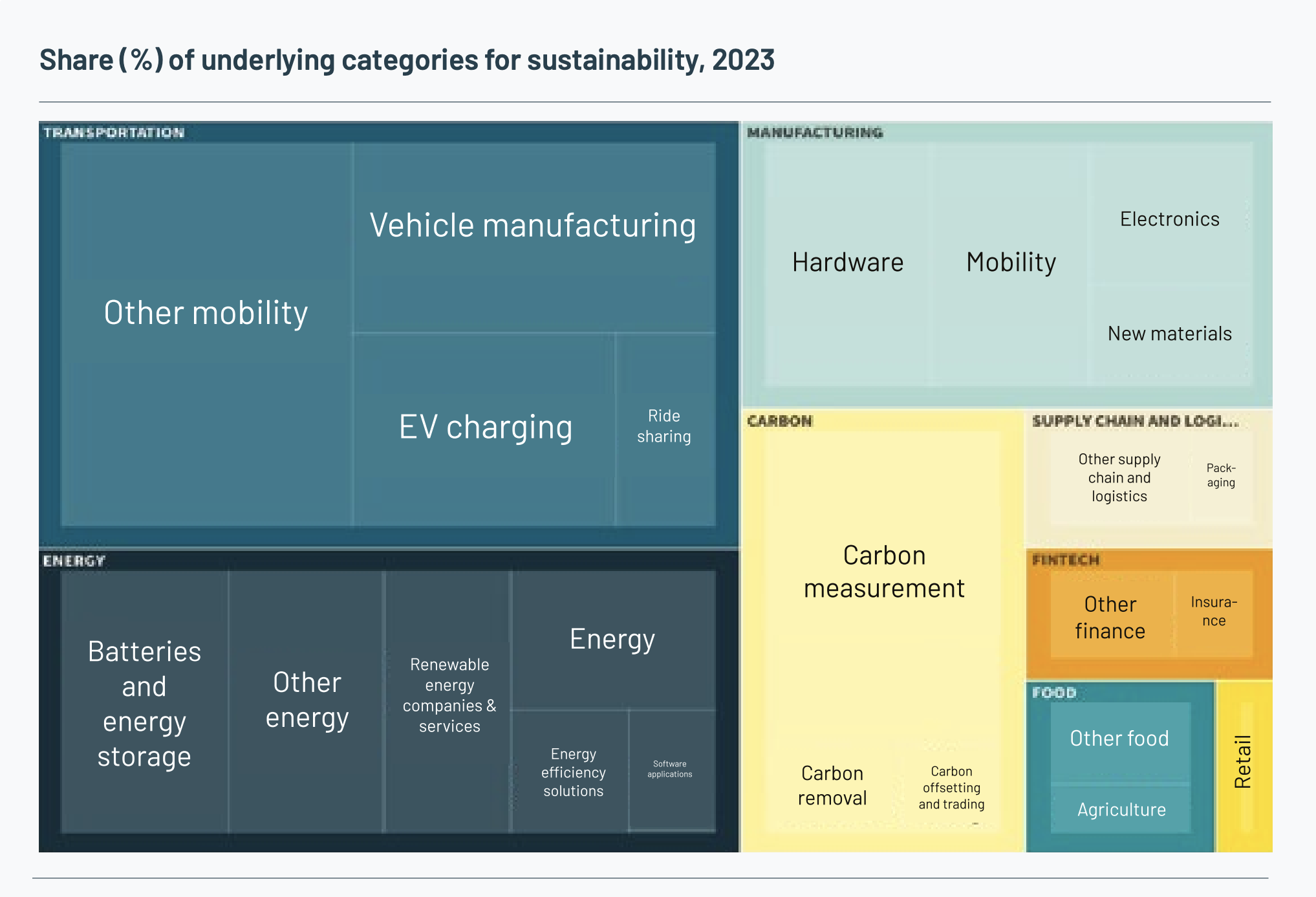

Looking at the distribution of capital invested in 2023, the largest flows of capital under the 'Sustainability' theme went to the Transportation, Energy, Manufacturing and Carbon sectors.

Transportation alone accounted for 33% of all capital invested under the Sustainability / Climate theme in European tech in 2023, followed by Energy (24%).

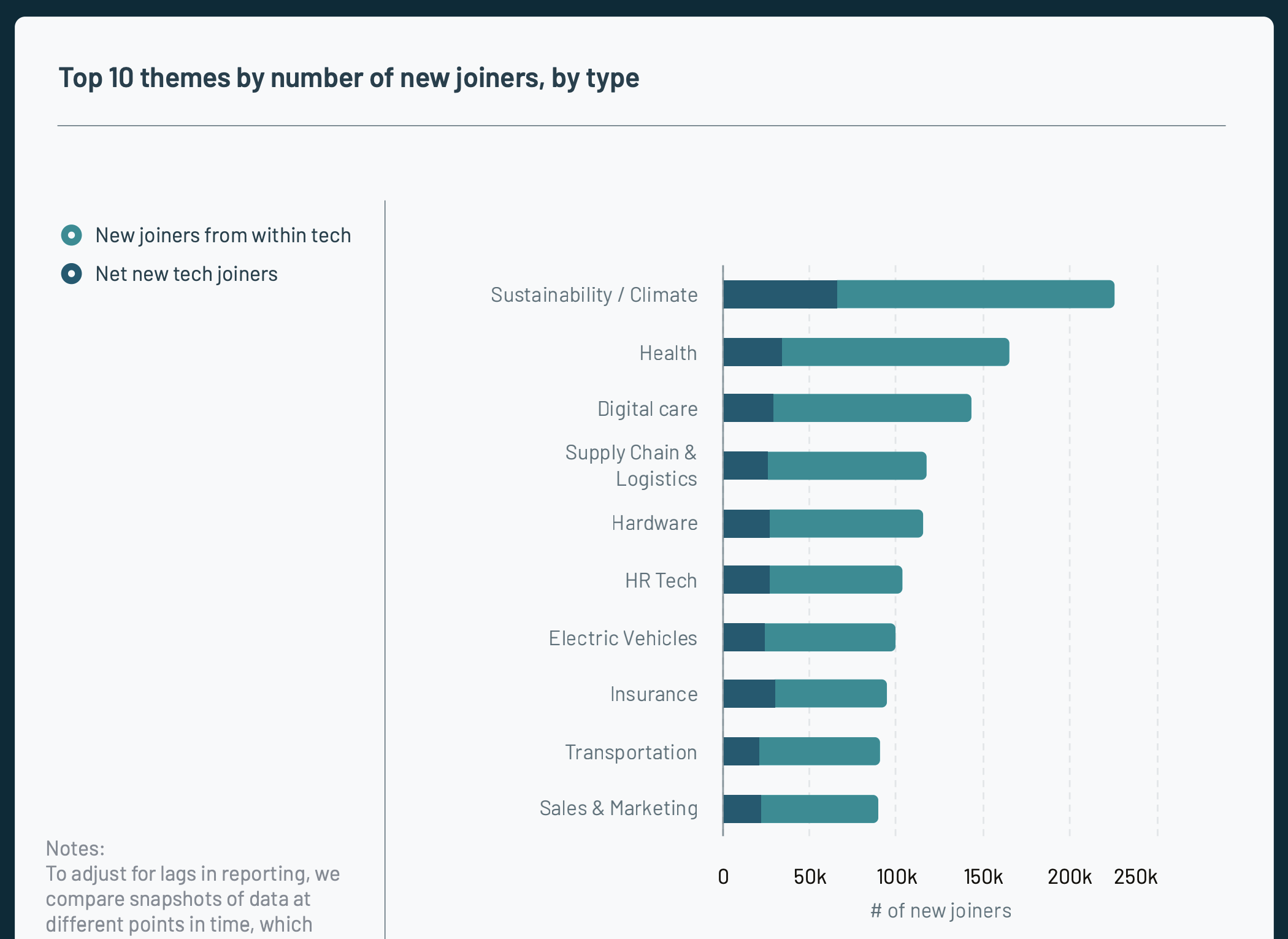

Atomico also looked at the flow of talent into and within the tech industry, broken down by theme.

Atomico also looked at the flow of talent into and within the tech industry, broken down by theme.

Sustainability and health take the #1 and #2 spots for 2023, clearly reflecting the "powerful magnetic effect of purpose-led companies in attracting talent".

Also rising fast, and particularly in the early stages: AI.

Also rising fast, and particularly in the early stages: AI.

As the report puts it, there's a "huge number of companies popping up to capitalise on the wave of innovation ignited by breakthroughs in large language models (LLMs)."

This has notably catapulted AI/ML to the top of the charts as the number one earliest-stage category, as ranked by the count of rounds of investment of $5 million or less.

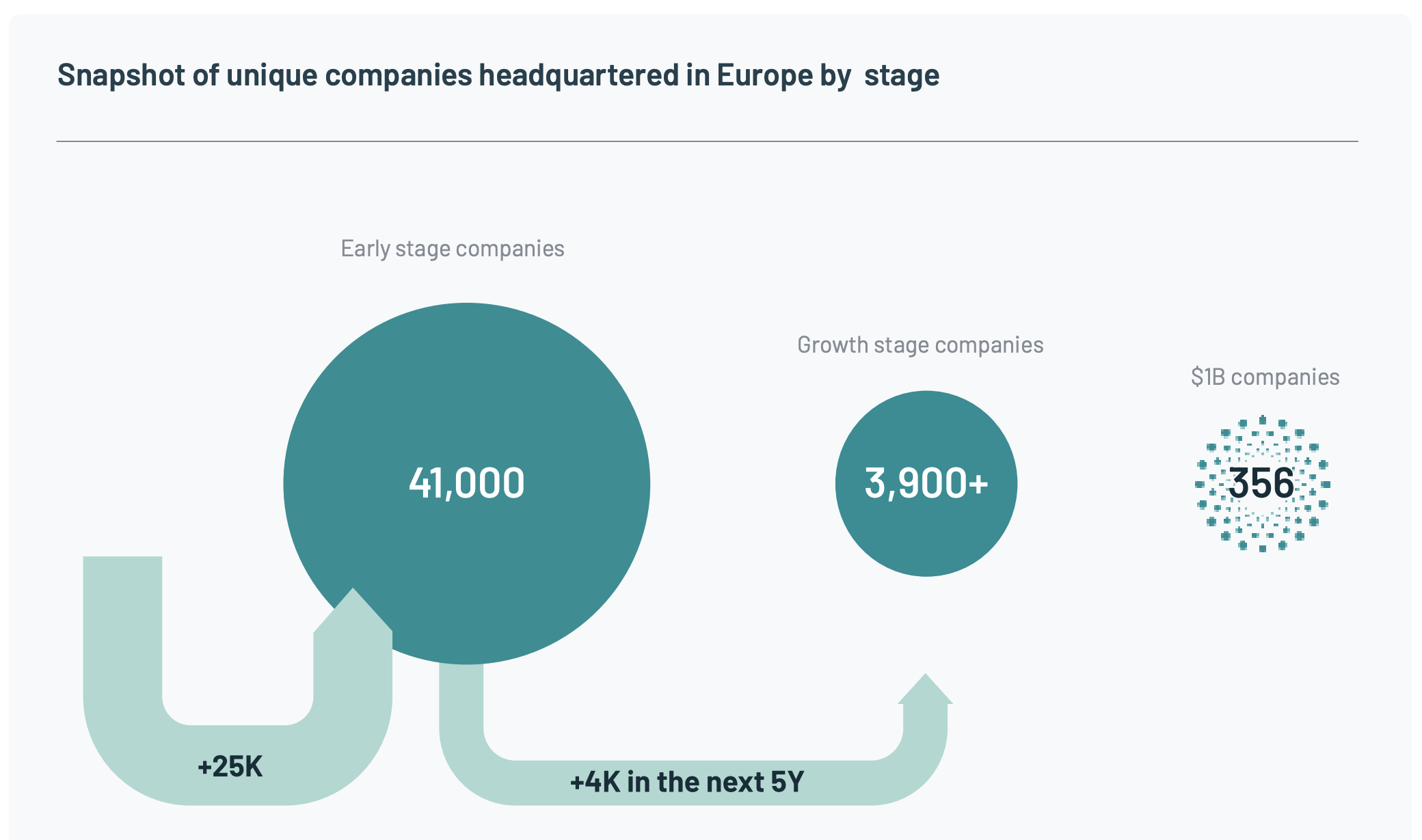

Atomico and partners have identified around 41,000 startups in Europe and nearly 4,000 growth-stage tech companies that have the potential to become the next generation of European breakout success stories, which is something the EIC Scaling Club is keen to play an active role in making happen.

Obviously, there is a lot more to unpack in the full report, so check it out.

About the EIC Scaling Club

The EIC Scaling Club is a curated community where 100 European deep tech scale-ups with the potential to build world-class businesses and solve major global challenges come together with investors, corporate innovators and other industry stakeholders to spur growth.

The top 100 European deep tech companies will be carefully selected from a pool of high-growth scale-ups that have benefitted from EIC financial schemes, other European and national innovation programmes, and beyond.

The EIC Scaling Club is an EIC-funded initiative run in partnership by Tech Tour, Bpifrance (EuroQuity), Hello Tomorrow, Tech.eu (Webrazzi), EurA and IESE Business School.

Related Articles

Recent Articles

Modvion: Reaching new heights with wooden wind towers

2 Feb 2026

.webp?width=2501&height=1406&name=EIC_Scaling%20Club_general_Twitter%20(1).webp)