17 Feb 2026

.jpg?width=2000&name=EIC_ScalingClub_Banners_Blog%26SM_ThreatMark%20(1).jpg)

Digital banking fraud today is dominated by social engineering and, increasingly, sophisticated scams. ThreatMark is a fraud prevention company that helps financial institutions defend their digital banking channels against these ever-evolving threats. The company is an EIC Scaling Club member in the “Digital Security & Trust” market group.

Ethical hacker veterans Michal Tresner (CEO) and Kryštof Hilar (CTO) co-founded ThreatMark in 2015. Their extensive careers testing security for banks and telecom operators revealed a serious vulnerability: most existing fraud prevention measures were useless against modern attacks. Recognizing this critical gap, they built ThreatMark as their solution.

Today, ThreatMark boasts a 95-person team and has secured roughly $22 million in funding. The company is currently fundraising a series B round and actively seeking investors, particularly those from Europe or the US.

%20(1).jpg?width=2048&height=1365&name=DSC06429%20(2)%20(1).jpg) Unmasking fraudulent behavior with sophisticated systems

Unmasking fraudulent behavior with sophisticated systems

These days, when attackers are criminal organizations, not individual fraudsters, ThreatMark’s complex AI system responds to threats in an equally sophisticated way. Using machine learning and AI, ThreatMark’s solution analyzes millions of inputs across all digital banking channels, including user behavior, attack infrastructure, and movement of funds. It monitors the entire attack lifecycle, from preparation (phishing pages) to execution (credential theft and money laundering) to identify and stop fraud at any stage.

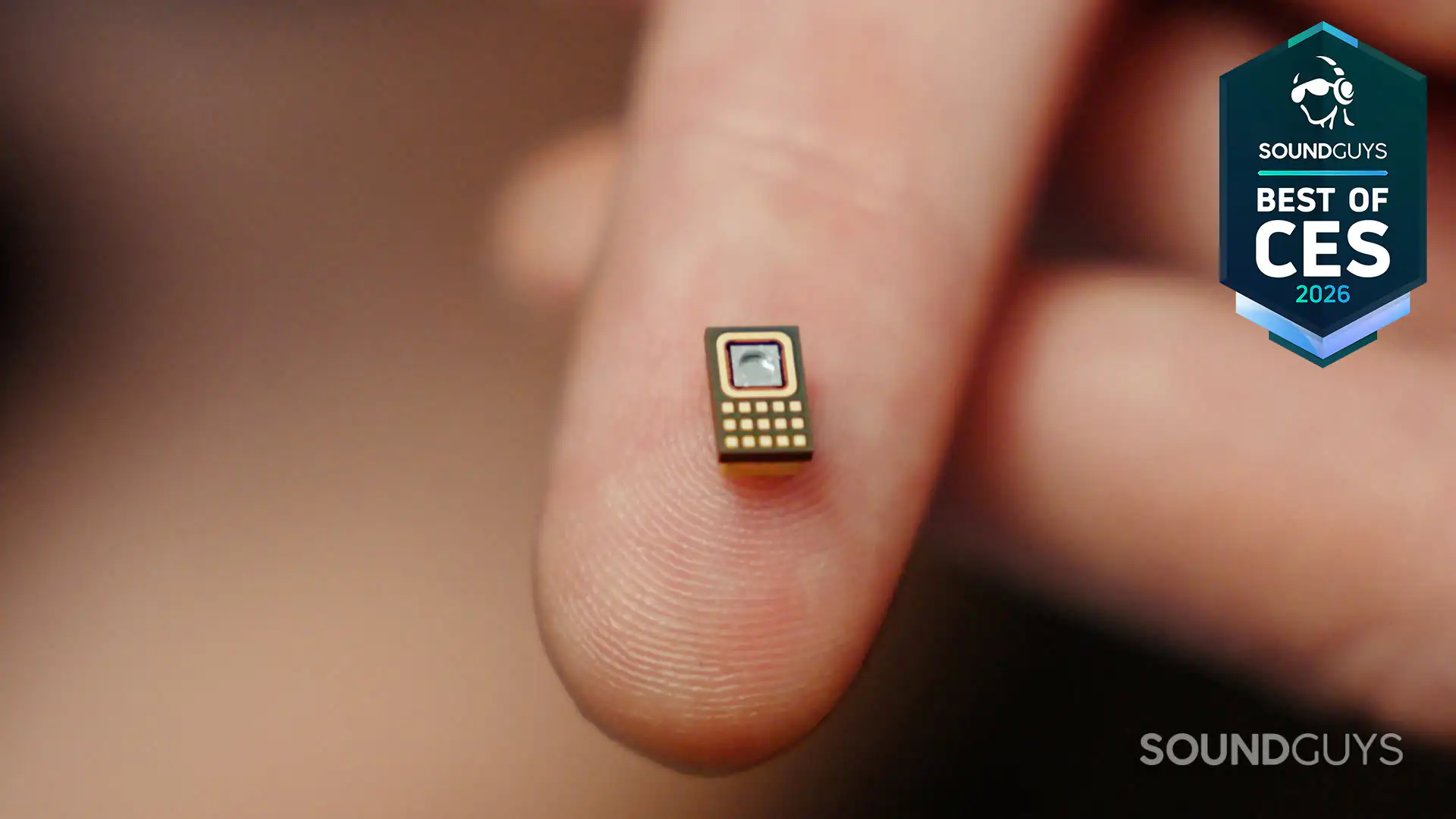

One unique technology analyzes user behavior through phone sensors, like a gyroscope and accelerometer, to differentiate legitimate users from fraudsters based on subtle movements like holding your phone or finger movements. This is one of many signals that the company uses to detect fraud.

Selling complex solutions to large institutions requires long sales cycles and significant resources. Despite that, ThreatMark has achieved impressive 80% YoY growth, reaching $7.5 million in revenue and targeting $10 million by year-end.

“Our multi-year contracts differ from typical month-to-month SaaS models, making it challenging to apply standard SaaS metrics directly. However, this structure has a significant advantage: it fosters exceptional customer stickiness. Banks using our service tend to stay on board for the long term, as evidenced by our zero churn rate to date,” Michal Tresner says.

Success breeds success

TheatMark’s nine-year journey transformed them from a Czech startup to a US-headquartered company selling globally. The team worked hard to build trust and credibility among banks and form a strong network of around 100 reseller partners.

TheatMark’s achievements have grown with the company. Their early milestones included landing the first customer, then securing a contract with a multinational group of banks. Each next milestone was greater and greater, including the largest bank in a specific region, a major Swiss bank, a bank in a legally complex region, etc.

“Our most recent significant achievement was our first US customer. We're now targeting even larger partnerships for broader market reach,” ThreatMark’s CEO explains. “Building trust with major institutions was a key hurdle, but we've successfully established ourselves as a reliable partner.”

Fueled by trust from top-tier banks across Western Europe and the US, ThreatMark is poised for accelerated growth. This is where their participation in the EIC Scaling Club becomes crucial. As Michal Tresner emphasizes, gaining visibility and spreading their message as widely as possible is a core reason for joining the Club.

So, good luck – and we will look forward to more grand achievements from ThreatMark!

About the EIC Scaling Club

The EIC Scaling Club is a curated community where 120+ European deep tech scale-ups with the potential to build world-class businesses and solve major global challenges come together with investors, corporate innovators and other industry stakeholders to spur growth.

The top 120+ European deep tech companies will be carefully selected from a pool of high-growth scale-ups that have benefitted from EIC financial schemes, other European and national innovation programmes, and beyond.

The EIC Scaling Club is an EIC-funded initiative run in partnership by Tech Tour, Bpifrance (EuroQuity), Hello Tomorrow, Tech.eu (Webrazzi), EurA and IESE Business School.

Subscribe to our newsletter here to stay up-to-date!

Related Articles

Recent Articles

Modvion: Reaching new heights with wooden wind towers

2 Feb 2026